Introduction

The geopolitical fall out from events in Afghanistan along with regional involvement (Qatar & Turkey) and Pakistan’s insistence for western governments’ help in Afghanistan, will be unsettling for regional Arab states in the weeks and months to come. The world waits with bated breath to see how a so-called readjusted Taliban effectively take power and prevent Afghanistan spiraling into economic decay. The recent conference in Baghdad will hopefully help establish a cohesive regional initiative to tackling the issues facing this readjustment.

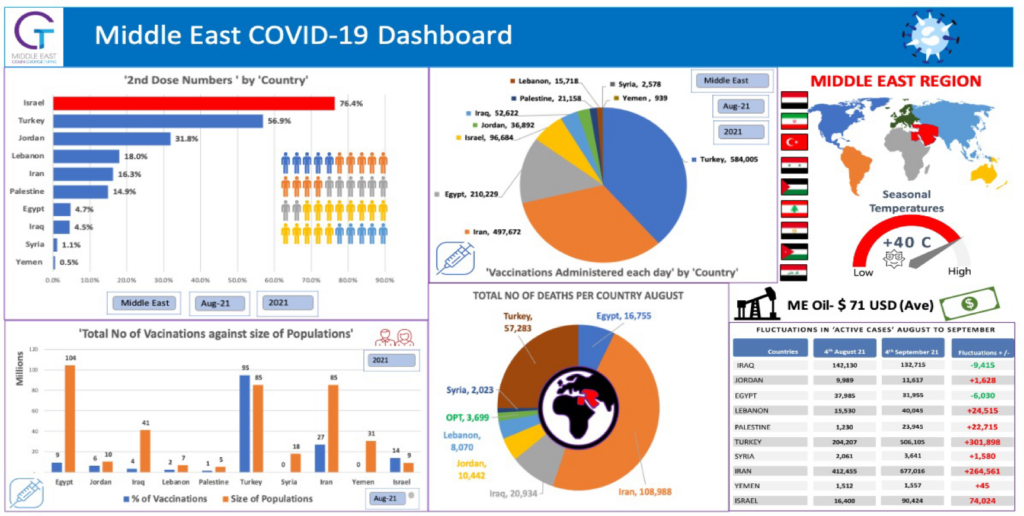

The GCC’s fight against the pandemic continues with both the collective and individual vaccination programmes all doing well. As the statistics in this Newsletter indicate, there have been improvements across important elements such as death rates, number of cases and active cases in the community. Certain countermeasures remain in place and vary from country to country but overall, these countries are gradually opening up as the vaccination numbers steadily rise and confidence grows. The use of health passports through technology and use of phone apps is proving a valuable investment for authorities and crucial in remaining ahead of the virus.

Gulf economies continue to benefit from the high oil prices, having recovered again after the recent dip below USD70 a barrel. Those economies with non-oil sector manufacturing and service inputs to their GDPs, continue to remain in growth territory. The opening of Expo 2020 in the UAE this October will serve, not only as an economic barometer in the coming months, but will highlight the confidence of businesses and people’s willingness to travel, particularly with World Cup 2022 in Qatar and Saudi Arabia 2030 diversification projects.

Geo-politcal (Snap Shot Middle East)

On the 28th August Iraq hosted a conference in Baghdad bringing together a multitude of regional players, including among others, Saudi Arabia, UAE, Qatar and Iran. This move by Iraq is aimed at bolstering its position and influence by mediating among rivals in the region in its efforts to eliminate being used as a punch bag of rivalry and wrangling between various powers. It is important to note that the US and Israel were not at the talks. The continued damping down of US Middle East foreign policy by the Biden administration, will raise security concerns for these Arab countries, who now realise the new reality of having to fend for themselves. The US pullout from Afghanistan will only strengthen Israel’s position as a regional power, particularly in its role of providing checks and balances against Iran. Turkey’s President did not attend the conference, opting to send his Foreign Minister; a clear sign that Turkey still needs to do more with regards to its confrontational foreign policy, despite recent moves to mend fences with Egypt, Saudi Arabia and UAE.

French involvement is not only geared around peace and stability, but also economic gain with its pledges of reconstruction and investment, which will undoubtedly irritate Ankara. France has also pledged maintaining a military presence even if the US withdraws from Iraq. Turkey remains a major player in the region and the events surrounding the Afghanistan withdrawal will only embolden its influence.

Despite the good will of genuine players in the region, the instability in Yemen, Syria and Lebanon will continue and serve as means of exploitation by various players for political and economic gain, while others will use it as a platform to undermine the Baghdad initiative. Extremists will look to capitalise on the Afghan readjustment in a hope to gain a stronger foothold in the region.

Covid-19 remains a fly in the ointment and as the dashboard data in this Newsletter highlights, there are two distinct camps in the region’s fight against the pandemic. The continuing struggle against the virus by the majority of countries surrounding the GCC will continue to impact on government domestic policies and economic survival, who will undoubtedly turn to their wealthier neighbours for fiscal help.

Middle East News

- Afghanistan: Qatar and Turkey become the Taliban’s lifeline to the outside world. The world’s powers are now scrambling to exert influence amid the return of the country’s Islamist rulers.

- Qatar is working with the Taliban to re-open Kabul’s airport as soon as possible. Qatar is also urging the Taliban to allow Afghans to leave.

- Palestinian President Mahmoud Abbas has held his first official meeting with a senior Israeli in more than a decade.

- Saudi Air Defenses intercept ballistic missiles over Dammam, which resulted in 2 Saudi injured and some damage to residential homes.

- Israel has named its first ambassador to Bahrain, after normalising relations with the Gulf Arab state a year ago. Bahrain’s first Ambassador to Israel, Khaled Yousif Al Jalahma, arrived in the country this week.

- Egypt’s President held talks in Cairo on Thursday with the King of Jordan and the President of the Palestinian Authority aimed at reviving the Middle East peace process and strengthening the ceasefire

- A delegation of four U.S. Senators said Wednesday that America is looking to help Lebanon overcome fuel shortages. But they warned the import of Iranian oil could have ‘’severely damaging consequences.’’

- US President Joe Biden has said that if diplomacy does not resolve the Iranian nuclear crisis, America ‘’is ready to turn to other options’’.

Covid-19 Overview (GCC)

The GCC vaccination programmes continue unabated with Saudi Arabia maintaining a high daily inoculation rate, achieving 54.5% of its population with two doses. The UAE is nearing 100% of its population being double vaccinated (18.29 million doses), Qatar and Bahrain also exceed the number of 2 doses to total population ratio, achieving 78.3% and 75.9% respectively.

Oman have also been pushing hard during August with its vaccinations programme, achieving 56,000 inoculations a day while Kuwait continues its catch up campaign. The strong Covid-19 countermeasures in Qatar continue to keep statistics down with a total of 2 deaths over August and a slight increase in the number of active cases in the community. The other GCC members have also seen a significant drop in their active cases with the communities. The number of daily cases for the UAE continue below 1,000 and others range from 100 to 200 daily cases ushering in a continued downward trend over August, against the highs of June and July 2021. The Delta variant is present in all the GCC countries however, the continued strict controls within these countries has helped reduce the foot hold of this particular strain of virus, unlike the fourth wave taking hold in Europe and the US at the moment.

The UAE continues with its 3rd and 4th inoculation programme to enable people to travel with a recognized vaccine, as certain countries around the world do not recognise the Chinese vaccination (Sinopharm). The GCC maintains its strict Covid-19 countermeasures in its fight against the virus, while trying to keep business travel open albeit through tedious online protocols and documentation compliances.

Statistics are based on populations requiring 2 doses to eligable groups within those populations 2nd September 2021

Economic Growth (Snap Shot)

The continued strength of the oil price aids the GCC pandemic recovery after the GDP contraction of 2020. Gulf economies are expected to return to an aggregate growth of 2.2% in 2021 with further increases for all six countries in 2022. The three main economies (Qatar, Saudi Arabia & UAE) continue their investment in infrastructure projects and telecommunications sectors, which includes 5G, while the remaining countries will be reliant on continued strong oil prices and fiscal support for their public sector spending from other coalition members. The aforementioned three economies all remain in positive territory with regards to their own non-oil sector indexes (PMI). Oman’s non-oil sector remains fragile, austerity measures and the introduction of VAT is set to slow recovery due to reduced domestic demand. Bahrain’s frail fiscal metrics and high spending requirements pose a risk to its overall outlook. Kuwait will find recovery hard due to its inability to implement a long-term financing strategy, which landed them with a S&P Global Rating downgrade to A+. Geopolitical tensions, fragile fiscal positions and pandemic related uncertainty will continue to pose downside risks to all these GCC countries.

Surround Arab Countries to GCC

As the statistics above show, the majority of Middle East countries outside of the GCC continue to struggle with their vaccination programmes. Turkey continues to make good progress, with over five hundred thousand maintained inoculations a day; this continued push has enabled it to grow its vaccination percentage a further 16% over August. However, the number of active cases in the Turkish community is high (506,105), a jump of over 300,000 over the month of August. Its death rate has continued to climb from the lows of July to over 250 a day in August.

Iran has quadrupled its percentage of the population vaccinated over the past month having gone from approximately 150,000 inoculations a day in August to nearly 500,000 at the start of September. However, this has not reduced its active cases within the community, growing from 412,000 in August to 677,016 in September. Iran is also seeing its highest daily death rate since March 2020.

Israel is another country that has uped its game with regards to inoculations, increasing its daily programme tenfold to just under 100,000 a day in its response to the Delta variant. The number of active cases in the community has risen dramatically and the death rate has gone from single figures to over forty a day in September.

Egypt has the largest population within the Middle Eastern countries featured in this Newsletter and has only managed 4.7% of its population inoculated, a rise of only 2.2% over August. Despite this slow progress the active cases have reduced and death rates are below 10 a day. Jordan continues to increase its vaccination numbers, now at 31.8%, a slight increase in the active cases and deaths stabilising below 20 a day. Palestine pushes hard across all Covid-19 fronts and continues to progress well. Iraq suffers from 60 plus deaths a day, over 132,000 active cases in the community and a struggling vaccination programme. Lebanon’s vaccination programme is slow, its daily death rate is below 10 and its active cases are on the increase. The conflict zones of Syria and Yemen remain at high risk.

Statistics are based on populations requiring 2 doses to eligable groups within those populations 2nd September 2021