Introduction

Despite the presence of the Covid-19 Delta variant in the Middle East, the well-established controls and the successes of the vaccination programme in the GCC, are undoubtedly contributing to the effectiveness of these measures, which is borne out by positive statistics coming out of the region. Confidence in these established protocols will be contributing to the gradual easing of entry restrictions for an increasing number of Gulf States. Concerns remain in place regarding the Delta virus strain as the surrounding countries in the region continue to struggle on the Covid-19 containment and vaccination

front.

The rise of oil prices ($76 USD) beyond the breakeven point of $65 USD for the Gulf States will continue to aid economic recovery for the GCC economies. Any further rise due to OPEC+ and the UAE’s current dispute over quotas, which may drive prices up even further, could impact the wider economic global picture as some countries struggle with pandemic fiscal deficits. Non-oil productivity for the most part, continues in an upward trend for the big three economies in the Gulf.

The Gulf States have been focused on their internal fiscal and Covid-19 issues with their foreign policies taking somewhat of a back seat. UAE continues with its Israeli relationship with a number of diplomatic visits to the Emirates this month. Overall the GCC continues in a positive manner on its journey back to fiscal prosperity and the road to a new normal.

Geo-political (Snap Shot Middle East)

The Biden administration continues the unenviable task of establishing its own working relationships in the Middle East. Russia, Turkey and Iran foreign policies remain an antagonistic ingredient in a complex cooking pot that is the Middle East. Recent Iranian hardline political appointments, Russian cooperation on Spy satellite, nuclear, economic and Covid-19 impacts will only continue to exacerbate issues in the Region. US military strikes against Iranian backed militias in Iraq and Syria only fuel Iran’s unrelenting determination to dominate in the region and will undoubtedly take advantage of the new Israeli political landscape in the coming months. Allies in Russia and China will give Iran the two legs needed to stand up in the medium term. Russia leverages the antiquities (restoration programme) sector in Syria as it continues to gain a foothold in Syria, it continues its efforts to close border crossings for humanitarian aid in order to funnel aid through Damascus, which only serves to benefit the Assad regime. Russia also has its eyes set on Yemen, which again demonstrates its continued aggressive self-serving Middle East foreign policy.

Turkey’s recent sideline talks at the NATO Summit with the US President revealed no changes, economic sanctions continue as a result of the Russian air defense system and US support of the Kurdish militias in Syria remains a thorn in the side of the Turkish administration. Turkish relations with Egypt took a backwards step as Egypt’s highest court upheld the death sentence for 12 Muslim Brotherhood (MB) leaders. Turkey along with Qatar remain strong supporters of the MB, with a large exiled contingent residing in Turkey. The issues on Turkish and Egyptian involvement in Libya is another bone of contention between these countries. Iraq looks towards NATO for security support in the form of a training and advisory nature as it broadens its security vision. This extends to regional cooperation as the recent visits by the Egyptian President and King Abdullah of Jordan to Iraq would demonstrate. The reliance on US military forces remain and will prolong its presence in the short term, despite the political pressure from the Iranian backed popular mobilization units that form part of the Iraqi security landscape.

Political unrest for the Palestinian Authority (PA) and its President Mahmoud Abbas continues to play into the hands of Hamas. The use of arson balloons by Hamas against Israeli farming towns will put pressure on a fragile cease-fire between the two sides. As political wrangling prevents an IMF bailout for Lebanon, its currency losing 90% of its value against the dollar, the onslaught of enduring hardships continues as the Lebanese military look to the US administration for options to help the Lebanese military pay its troops in order to prevent state collapse. In the GCC, Israeli normalisation initiatives continue between Bahrain and UAE, with Israel officially opening up its Embassy in Abu Dhabi. Yemen continues its aggression against Saudi Arabia with no real prospect of any cessation in hostilities at this time.

Middle East News

- Israel: officially opens its embassy in the UAE (Abu Dhabi) with a consulate in Dubai.

- Iran: Iran to acquire Russian high resolution recon satellite capable of a resolution of 1.2 meters.

- US: forces in Syria come under attack after airstrikes on Iranian backed militias.

- Egypt: up hold death sentence on 12 Muslim Brotherhood leaders

- Russia: looks for a way back into Yemen. Moscow making tentative steps for deeper engagement in the Yemen war.

- Iran: may face a fifth wave of Covid-19 infections as the highly contagious Delta variant spreads through the Middle East.

- Oil prices: Brent Crude, the global benchmark has risen by more than 50% this year to stand at $76 USD a barrel.

- Jordan: King Abdullah of Jordan leaves for 3 week visit where he will meet President Joe Biden.

- US: The Pentagon and State department explore creative ways to help the Lebanese armed forces off set their costs amid financial crisis.

- Yemen: Yemenis express hope that new UN envoy will help end war.

COVID-19 Overview (GCC)

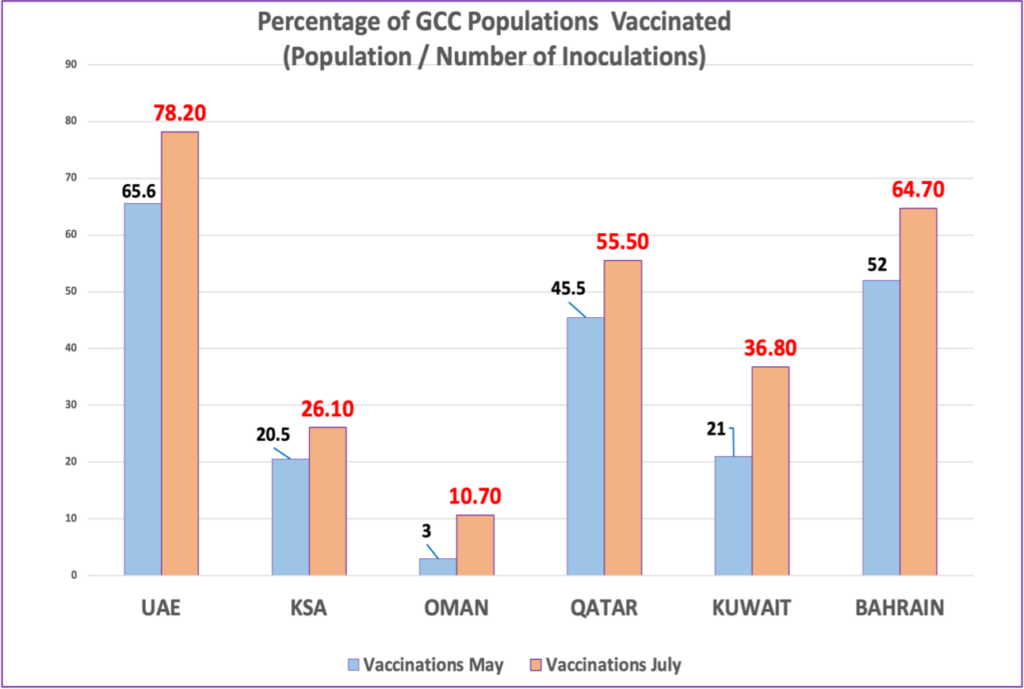

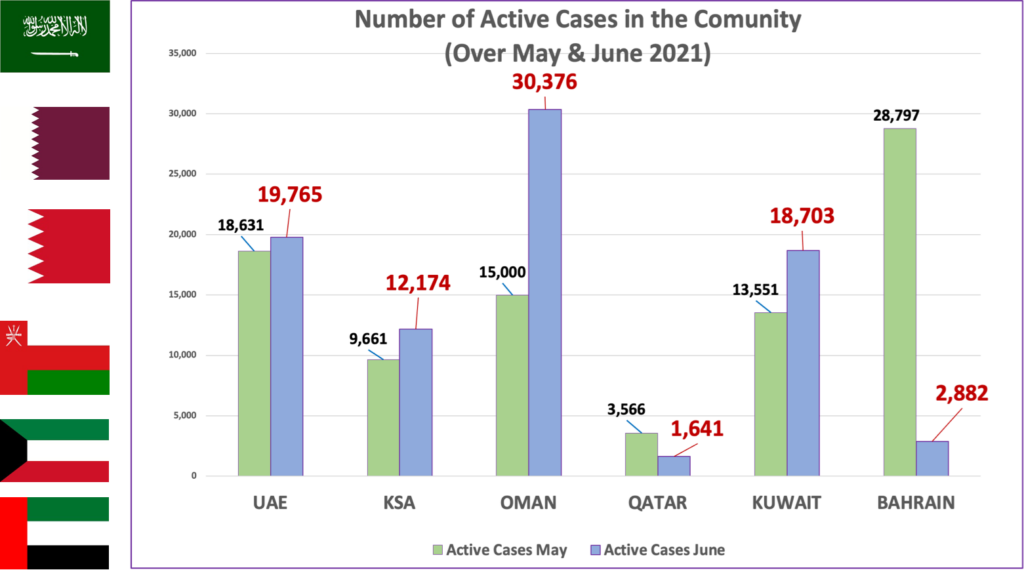

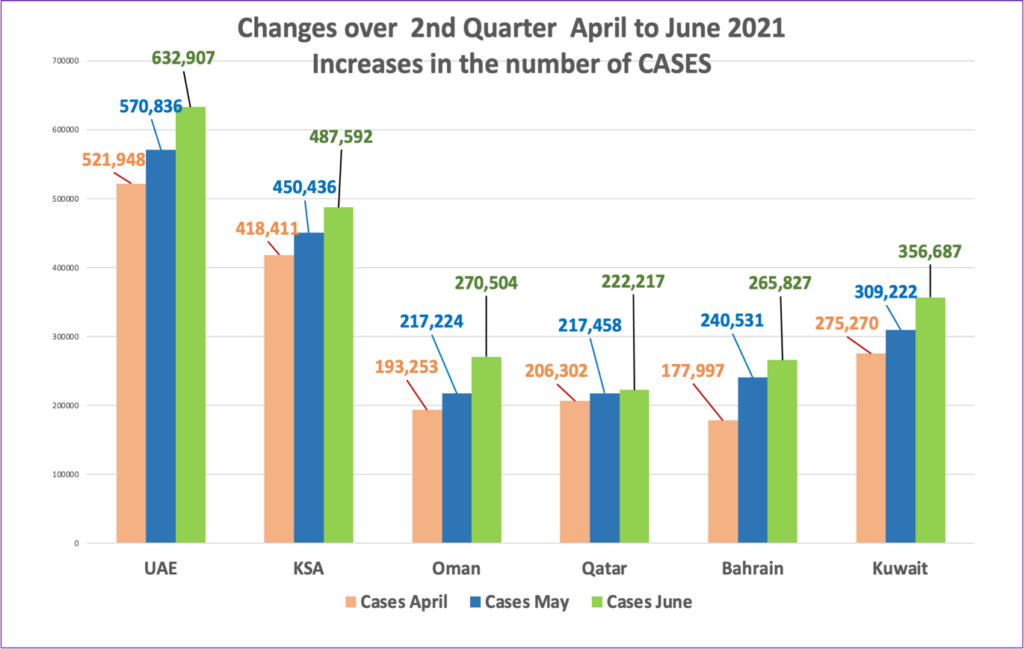

Despite the positive progress with GCC vaccination programmes we still see a mixed bag of data regarding the death rates across these countries. The three strongest vaccination programmes (UAE, Qatar & Bahrain) show a decline in death rates and positive results with regards to active cases in their communities. While UAE has seen over 60,000 new cases in June, Bahrain has seen a decline in its daily numbers and Qatar has consistently seen low daily case numbers over the 2nd quarter. The remainder of countries (KSA, Kuwait & Oman) have seen an upward trend with regards to deaths and active cases. Saudi Arabia has seen a moderate increase in the number of daily cases, while Kuwait and Oman have seen significant increases in daily cases. Oman continues to struggle on all Covid fronts, particularly with the number of active cases jumping from 15,000 in May to over 30,000 in June, the highest in the GCC.

UAE continues to do well with its vaccination programme reaching 78.2% of population (10,009,473 million) based on 2 doses being required for the entire population (15,362,342 doses given). There are numbers in the community now receiving boosters (3rd Jab). The number of active cases in the community has slowed over the month of June whilst the number of daily cases has continued around the 2,000 mark for June.

The momentum behind Saudi Arabia’s vaccination programme seems to have slowed (5.6% increase) somewhat in June, in comparison to other GCC countries, dropping from 162,000 daily doses in May to 106,000 daily doses in June. Despite the fairly low numbers of active cases the death rate has increased from 3 cases a day in January to that of 17 a day in June.

Oman continues to struggle and only achieved a total percentage figure this month (10%) with its vaccination programme. We have seen a huge jump in active cases in the community this month (doubled from 15,000 to 30,000). The daily death rate is now at 40+ in comparison to below 5 at the beginning of the year. Oman sees the second highest GCC increase in its overall number of daily cases this month.

Qatar has progressed its inoculation programme by 10% this month to 55.5% based on 2 doses being required for the entire population (2,807,805million). This focused drive seems to be set to achieve its goal of 10% vaccination of population month on month. They have practically halved the number of active cases in the population, a death rate down from 8 a day in April to sporadic 0-2 in June and approximately 5,000 new cases for that same month.

Kuwait continues to push with its vaccination programme achieving nearly 16% growth rate for last month. They are still seeing an increase in active cases within the community up over 5,000 cases in June. Similarly, some 47,000 new case increase in the month of June. This is an increase from the April – May numbers and their death toll continues to increase from 3 a day back in January to 10+ in June.

Bahrain has seen a significant positive reversal in its Covid-19 statistics. Active cases down from 28,000 in May to just under 3,000 in June. Vaccination programme is at 64.7%, its death rate down from 20+ to below 5 daily cases and 25,000 new daily cases for June from its 62,000 in May.

While vaccination data varies across a number of popular current platforms, the Reuters Covid-19 tracker has been used in this report.

Statistics from John Hopkins University 2nd July 2021

Economic Growth (Snap Shot)

The OPEC+ continuing controlled output has contributed to a 2% rise in oil prices, with the majority of suppliers at $74 -$75 dollars, as it reacts to the increase in global demand. The dispute between UAE and OPEC+ could see output controls run through August, which could push prices to $80 quickly, impacting the global economic recovery. Economic expansion continues for the three main GCC economies (UAE, Saudi Arabia & Qatar) in the non oil economic sectors, all of which have stayed above the 50-mark that separates growth from contraction for both the 1st and 2nd quarters of 2021. Firms continue to raise output and staff numbers increased for three of the last four months; a positive sentiment remains for the year ahead. The remaining three GCC economies will certainly benefit from the increased oil prices, which remains their biggest GDP revenue stream.

Saudi Arabia has recently opened up to international travel, UAE continues to do the same with overall numbers of Covid-19 cases responding to the aggressive vaccination programme across the region, despite the presence of the Covid-19 Delta variant.

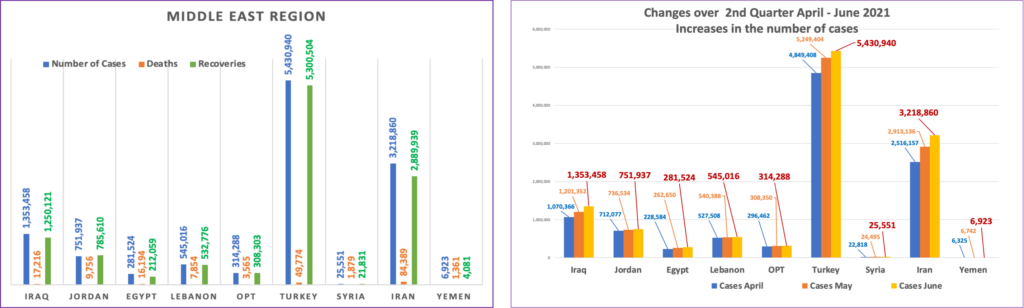

Surrounding Arab Countries to GCC

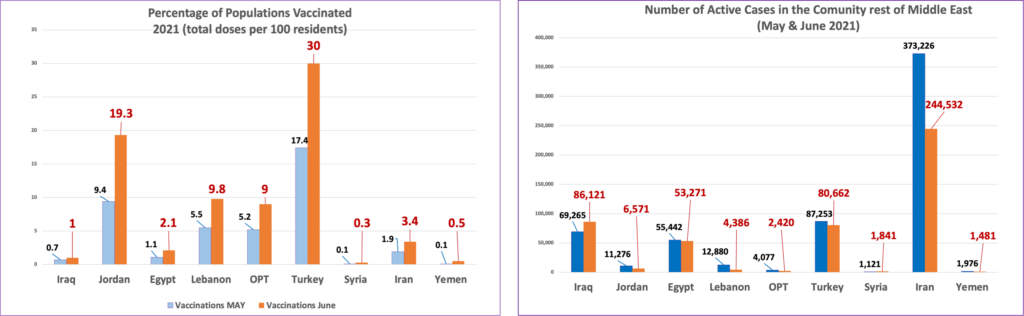

For the vast majority of Arab countries featured in this Newsletter, they remain with below 10% of their populations vaccinated and half of them below 5%. Despite these figures, we have seen a slowing down in the number of new daily cases overall. Iran still sees huge numbers of 300, 000 new cases over the month of June, closely followed by Turkey with 180,000 new cases and Iraq, another one of these surrounding countries to the GCC, coming in at 152,000 for June.

Iran has managed to stabilise its daily death toll which is averaging around 150 deaths a day for June. It has achieved a 3.4% of population vaccinated based on 2 doses being required for the entire population (85,063,982 million) and has also reduced its active cases in the community by approximately 130,000 in June.

Turkey has achieved a 13% growth rate in its vaccination programme, achieving 30% of its population based on 2 doses being required for the entire population (over 85 million). Like Iran, it has also seen a reduction in the numbers of active cases in the community. Equally it continues to see a steady decline in the number of daily deaths, averaging around 50 a day in June.

Iraq is the only country in the nine featured in this Newsletter that has seen an increase in the number of active cases in the community; an increase of approximately 16,000 cases. Again, it struggles with inoculations achieving only 0.3% growth in the month of June, averaging 15,575 vaccinations a day across a population of over 41 million people.

Jordan is another of these countries to achieve a 10% growth (now 19.3%) in its vaccination programme based on 2 doses being required for the entire population (10.3 million people). Its daily case numbers have slowed and it has also seen a decline in the number of active cases.

Egypt has only achieved a 1.0% growth in its vaccination programme, which stands at 2.1% and its daily new case numbers continue to slow. It has reduced the active cases in its community in June albeit slightly (53,271, down from 55,442) from May.

Lebanon continues to push ahead with its vaccination programme achieving 9.8% of population (6.7 million people) inoculated, based on 2 doses being required for the entire population. The daily death toll remains in single figures, a two thirds reduction in active cases in the community and less than 5,000 new cases for the month of June.

The occupied territories (OPT) continue in a positive manner with their vaccination programme up to 9% from its previous 5.2% and active cases halved over June. Syria and Yemen have seen very little movement in their vaccination programmes, both remaining below 1.0% of population (18 million and 30 million respectively).

Statistics from John Hopkins University 2nd July 2021