INTRODUCTION

As the Eastern European crisis moves into its third month, the effects of sanctions on Russia from the global community, together with the lack of Ukrainian exports, are starting to bite hard in the region, particularly for the wider Middle East countries sitting on the periphery of the GCC. While the region has only now started to claw its way back from the recent impact of the Omicron strain of Covid-19, recent events will only compound the hardship of any recovery in 2022. The hype in oil prices due to the conflict will obviously benefit the major energy exporters in the GCC and Middle East. The increase in these revenue streams will benefit in the recovery of governments’ Covid-19 expenditure, channel funds back into public spending and help combat rising inflation and the effects of a disrupted global supply chain.

Middle East energy exporting countries with wider issues such as security, political instability, conflict, humanitarian responsibilities and heavy import dependencies will find recovery particularly severe. The political and security issues for the region are still there (Iran, Iraq, Syria, Yemen, and Lebanon) and as history teaches us there are always those who will seek to exploit the situation this region faces as a result of the wider conflict in Eastern Europe. However, recent pan-Arab sentiment and cooperation, driven by the richer GCC countries and their effective Covid-19 recovery, helped by high oil prices and a strong desire to counter the age old Sunni / Shia power struggle, will undoubtedly play its hand in collectively supporting their Arab neighbors in the months to come.

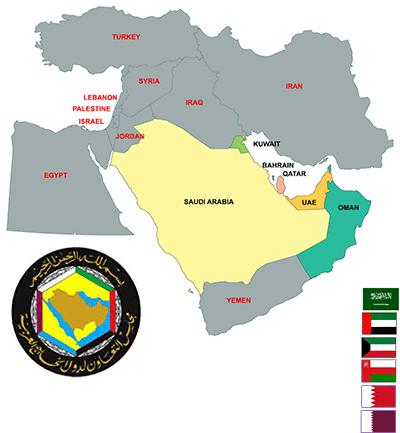

GEO-POLITICAL (SNAPSHOT MIDDLE EAST)

The war in Ukraine is a foreign conflict on another continent taking on a global dimension, a shift to the global geopolitical landscape and economic impact that cannot be ignored across the Middle East. Countries of the Middle East, particularly in the GCC region, adopted a cautious stance opting for a silent approach and only iterating their concerns on a humanitarian front. This initial silence for

many highlights the growing despondent attitude the Middle East countries have with Washington as consecutive administrations continue to scale back on their interests in the region. Russia has been quick to fill that void over the past decade (Opec+, commercial and investment projects). In less than two weeks the Middle East and North Africa’s stance on the Ukraine war has shifted. All but Algeria, Iran, Iraq and Sudan had voted in favour of the UN General Assembly resolution (2nd March) demanding Russia withdraw its forces. The four aforementioned countries have close ties with Russia on both a military and economic front.

Recent events in the Iraqi province of Sinjar becomes the latest flashpoint between Turkey and Iran. Turkey’s efforts at targeting PKK elements inside Northern Iraq and Iran’s proxiemilitia’s targeting Erbil (KDP) in Kurdistan, contributing to continued instability in Iraq. The formation of a new Iraqi government has been stalled since October 2021. The negotiations on the nuclear deal between Iran and the West remain at a stalemate. Tehran are also benefiting from high oil prices which may also be a factor in their reluctance to agree on nuclear issues at this time. Despite several meetings between Tehran and Riyadh in Baghdad since April 2021, both sides are still divided on a number of issues particularly Yemen.

Saudi Arabia, with backing from the West has attempted to install a friendly government in Yemen and a fragile cease-fire still holds. However, Saudi Arabia’s request for a US security pact does not sit well with Iran. Both Iran and Saudi Arabia continue to compete for influence in both of their close neighbors of Iran, Iraq and Afghanistan. Lebanon’s approaching parliamentary elections is a make or break moment for the country’s voters, a country still reeling from its economic crisis and the impact of Covid-19, fuel, electricity, food and medicine shortages as well as the devastating Beirut port explosion.

As a result of the Ukraine war Egypt faces rising inflation, currency devaluation and high external financing needs according to the IMF. Egypt is one of the world’s largest wheat importers and more than 50% of its imports come from Ukraine and Russia. Israel diplomacy regarding Ukraine and Russia continues despite the recent antisemitic statements from Sergey Lavrov, this approach is there to maintain its tacit agreement with the Soviets to fly missions into Syria against Iranian targets.

ECONOMIC SNAPSHOT

Economically the biggest fallout from the Eastern European crisis on the region involves energy. The top three oil producers are the US, Saudi Arabia and Russia respectively, with Russia’s total production topping 11.3 million barrels a day. Recent sanctions have reduced that output onto the market and consequently the US and UK requested the UAE and other producers to increase their output. The West’s request to increase production was snubbed

as Opec+ members agreed on a gradual production increase. Both the UAE and Saudi Government continue to box clever, maintaining their influence and independence to protect the global energy security, as well as their own interests. The energy exporters in the region have improved their fiscal position with oil prices having reached $139 USD a barrel in March and still maintaining a price at $112 USD a barrel in early May. This turn of events will greatly improve certain GCC exporters economic bottom line despite the rise in inflation and commodity prices. The regions poorest countries will suffer significantly as energy and food imports will undoubtedly impact severely.

Commodity prices and in particular food costs will continue to rise and the impact of wheat imports for the region are significant, bearing in mind Ukraine and Russia account for 30% of global exports. Lebanon (96%) and Egypt (80%) are heavily reliant on wheat imports from these two countries. Both Yemen and Palestine face similar hardships. Syria has already started to ration key commodities such a wheat, sugar rice, potatoes. As global impacts (Ukraine, China, supply chain disruption, Inflation, Covid) continue and both the GCC and wider Middle East, particularly the poorer ones, face continued financial, economic and security hardships for some time to come.

Russian interests benefiting the region are at risk as investment in the Egyptian El Dabaanuclear power plant, reactors for Iran and the Quma-2 oil field in Iraq (Russia’s Lukeoil) remain uncertain. Materials prices were already increasing due to the impact of the Covid pandemic on supply chains before the crisis hit. Russia and Ukraine are among the largest global suppliers of steel. Iron, Nickel and Aluminum have all seen significant rises in prices which will ultimately impact on the construction sector for the Middle East. The economic damage from the conflict will contribute to a significant slowdown in global growth in 2022 and will continue to add to the region’s inflation.

MIDDLE EAST NEWS

Oman on cusp of introducing personal income tax.

Attack on Sinai checkpoint kills 11 Egyptian troops, says army.

1. Lebanese parliamentary elections: Second phase of expat voting scheduled for Sunday.

2. Commercial airline passengers still apprehensive about flying in 2022, global survey warns, amid widespread misunderstandings re air travel health regulations.

3. Turkish President Erdogan’s visit to Saudi Arabia seeks to restore strained relations.

4. The central banks of the UAE, Saudi Arabia, Bahrain, Kuwait and Qatar increased their benchmark interest rates following the US Federal Reserve’s move to raise its key rate.

5. OPEC+ alliance endorses slight increase in oil production. Saudi Arabia and UAE settle on a marginal increase.

6. Iran’s rulers, emboldened by a surge in oil prices since Russia invaded Ukraine, are in no rush to revive the 2015 pact to ease sanctions on its energy-reliant economy.

7. Iraqi army gains control of Sinjar after battle with local militia in Northern Iraq (Kurdistan region).

8. ISIS attacks in Syria have declined ‘while new fighters join terror cells’ ; new recruits from Hassakeh jail break bolstering terrorist group’s ranks.

9. UAE records lowest number of Covid-19 cases this year, tally of low infections continues encouraging trend of declining numbers in 2022.

10. Jews celebrate end of Passover in UAE: Muslims and Christians gathered inside the Jewish Council of the Emirates in Dubai.

11. Consumer goods in Egypt are soaring: a rise of more than 23% of food and beverage prices, most notably vegetables, oils and grains.

12. Turkey’s diplomatic strides by normalizing its relations with Saudi Arabia and the United Arab Emirates, rapprochement with Egypt still seems a challenging prospect.

13. Saudi Arabia sends $50 million to Jordan for budget as economy falters.

14. Turkey’s national currency collapse has prompted Ankara to shift position in international and regional relations, which may affect Hamas’ presence in Turkey.

COVID-19 OVERVIEW (GCC)

The ravages of the Covid-19 Omicron strain in January and February 2022 have subsided across the GCC. Data for all six countries indicate a significant drop in active cases from the highs of 50-60,000 cases in early 2022.

Fifty percent of these countries are now reporting numbers well below 1,000 active cases in the community to that of 14,000 in the UAE, 3,500 in Saudi Arabia and 3,200 cases in Bahrain. Three of these countries last saw a Covid-19 death back in March and April, the remainder showing intermittent recorded deaths numbering 1 or 2 cases per day over the same period.

Daily cases of Covid-19 are highest in Bahrain (300-400), UAE (198), KSA (124), Qatar below 100 in May and no cases since April 25th in Oman. Kuwait for most of April has seen steady numbers below 100 cases, however a recent spike of 292 has been recorded May 6th.

Overall, the GCC has recovered well from the onslaught of Omicron at the start of 2022 and despite the UAE hosting the Expo 2020 exhibition (ending on 30 March) it continues to control its numbers. Most of the GCC countries have relaxed their Covid-19 travel restrictions allowing better freedom of movement both regionally and internationally. However, there are still some restrictions in place with regards to some public venues in some countries, particularly mask wearing and the use of a Covid-19 phone app.

Visitors travelling to the GCC should always check with government websites and their preferred airlines for travel in order to have the most up to date information for each country.

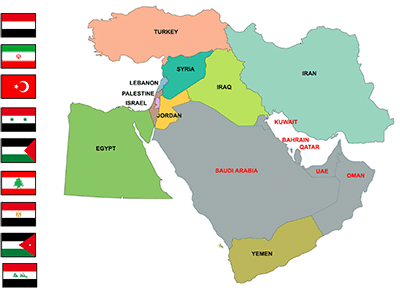

COVID-19 OVERVIEW (MIDDLE EAST)

Overall, the surrounding Middle East countries have also seen an improvement on the Covid-19 Omicron front. Countries such as Israel, Turkey and Iran continue to struggle with their daily and active cases numbers and death rates across all three of these countries continue to register between 10-20 deaths a day.

While Egypt has a low daily case rate it still has over 48,000 active cases in its community and suffered a spike of 55 deaths in a single day in April. The remaining six (Iraq, Jordan, Lebanon, Palestine, Syria and Yemen) countries surveyed have seen significant reductions in the exact areas (deaths, daily, active). While the region in general has seen a big improvement in its fight against the pandemic, the impact from the Eastern European crisis on inflation, certain foods (mainly wheat), economic recovery and energy requirements will undoubtedly slow or even pause economic recovery for many of these countries in 2022.